WindESCo Hosting Webinar August 18, 2022

Thursday, August 18 at 12:00 P.M. EST, WindESCo is hosting a webinar for wind industry owners, operators, asset managers and other stakeholders to...

WindESCo is a proud sponsor of the 2021 North American Power List. The list notes the top 100 business leaders in North America that exert the most influence on the wind industry through their deals, innovation and strategic thinking. At 92, is Mo Dua, founder & CTO of WindESCo helping firms use data to boost project operations.

Accompanying the Power List is a Q&A with WindESCo CRO, Ed Wagner.

It is now possible to employ a closed-loop system to optimize site-wide performance instead of risking overall AEP by optimizing individual assets alone, says Ed.

WindESCo operates globally and we are seeing differences regionally. Low wind conditions are impacting some regions while clustered sites, where wind turbines are too close to one another, are also facing challenges. More generally, we are hearing from operators that their wind plants are not meeting expectations as they come off warranty and we also observe significant variation based on the model and age of different turbine types.

How can operators and wind energy investors benefit by improving the performance of their wind turbines?

Wind operators benefit on sites with known (and sometimes unknown) underperformance issues by turbines being returned to intended design performance. Whereas asset managers and investors benefit by improving the asset or fleet profile by 1-2% in terms of AEP.

What steps can operators and wind energy investors take to improve the performance of wind plants?

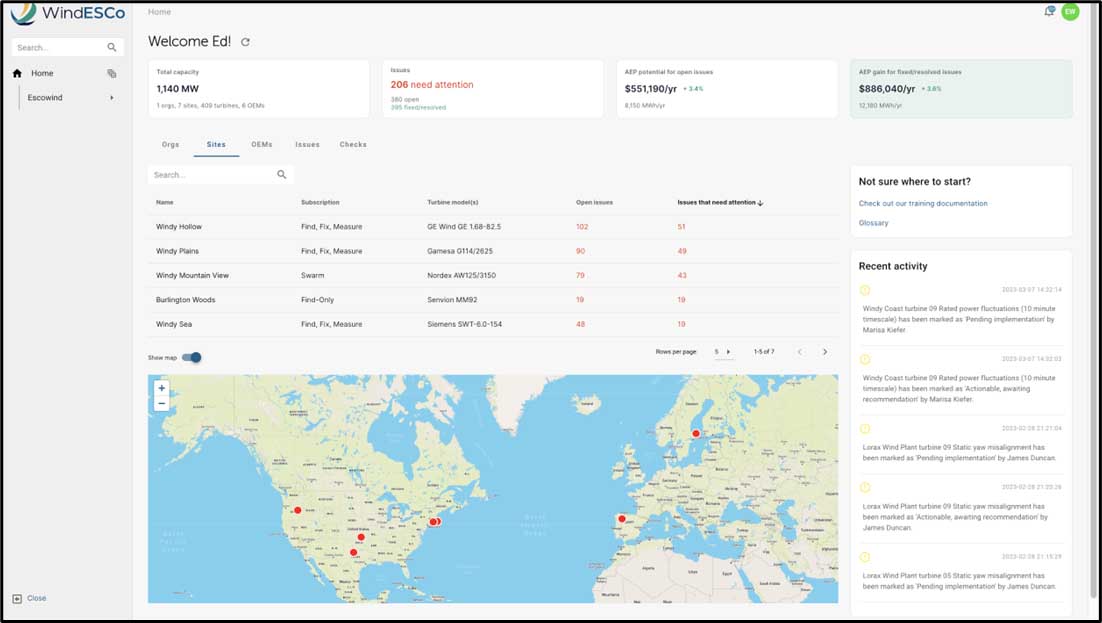

It is standard for operators to employ dashboards which identify new issues where risks to asset downtime may exist. To enable corrective actions and prevent recurrence, operators and investors need to understand why their plants are underperforming and how to correct them, rather than simply being alerted to reliability or underperformance issues. Such dashboards for reliability purposes can enable some analytics capabilities with standard SCADA data in ten-minute intervals.

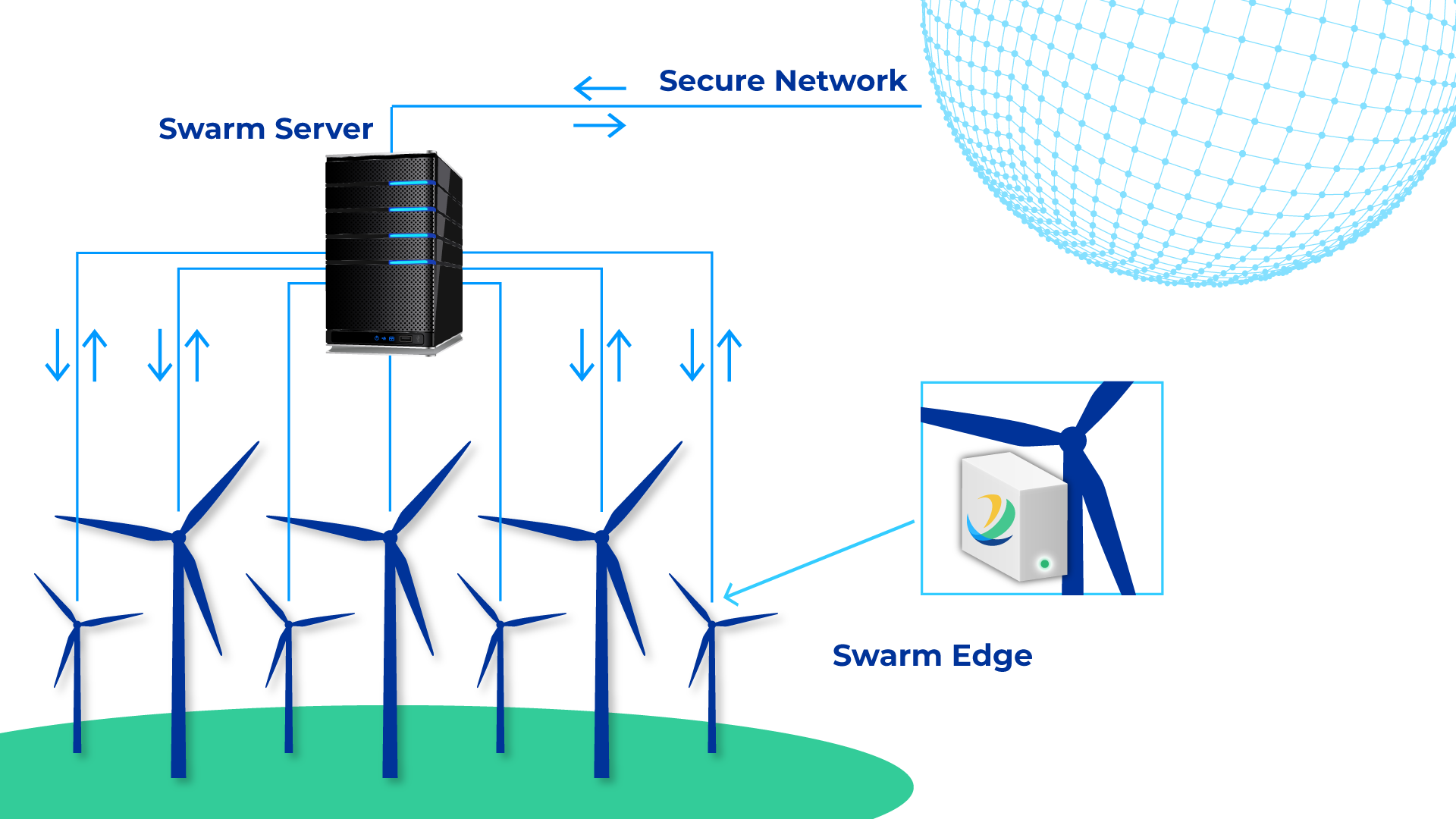

However, to enable more predictive capabilities as well as energy output performance, operators should employ analytics that utilize high frequency data. This is to identify the detailed behaviors within the components of moving systems such as pitch, yaw, rotation and the associated anomalies that lead to energy improvement opportunities. It is also possible to employ a closed-loop system at a wind turbine site to optimize site-wide performance instead of just individual asset performance.

Optimizing individual turbines alone could potentially negatively impact the site production as a whole or leave collective opportunities on the table. New solutions such as WindESCo Swarm analyze the site as a system optimization problem in addition to asset-by-asset improvements. When considering site-wide optimization, outcomes potential ranges from 3-5% AEP improvement.

What is your advice to operators or wind energy investors who suspect their wind plants are underperforming?

The operators and investors should employ deep experience and subject matter expertise in wind turbine operations and not rely solely on general data science. It is easy to identify the symptoms from the data differences, but it is extremely difficult to define a treatment plan that will improve performance and then measure and track results to the nuances of equipment technology such as controller design.

What do current technology solutions overlook that could improve wind plant performance?

Due to SCADA system standards, it is easiest to utilize existing ten-minute data. However, within the periods at lower time intervals, there is a more anomalous value opportunity that is often masked within the data. Independent power producers (IPPs) and operators need to look at high resolution data to pick up information about turbine operation anomalies that can be used to improve AEP. Users should look to vendors that support seconds-level data for high-value analytics.

What do you see as the biggest challenges in the wind industry today?

Managing operational models with varying types of renewables (including solar, wind and hydro) and the segmented supply chain. Variation between OEM standards and support for equipment models both aging and new. First, IPPs are experiencing energy price fluctuations that require additional flexibility to meet regional demand. They are struggling to remain profitable as our climate changes. Second, OEMs need to recognize that working to make their operators successful using all the tools and talent in the industry is the path to selling more wind assets. If the operators are successful, the entire industry succeeds. OEMs should be more open on behalf of their customers to implementing solutions that increase AEP.

What are the biggest opportunities for the wind industry?

In North America, with the continued extension of the production tax credits, we can repower more of the existing assets to improve performance and extend asset life. There is also an opportunity for North America to take advantage of the arrival of new offshore opportunities. From an independent software vendor point of view, we need to roll-up a number of the point solutions in the market, to make it easier for the operators to find, fix and measure anomalies and problems they have with their wind assets and business quickly and effectively. There's a lot to learn from other industries to keep costs low, while improving the services we bring to operators.

Thursday, August 18 at 12:00 P.M. EST, WindESCo is hosting a webinar for wind industry owners, operators, asset managers and other stakeholders to...

WindESCo, a pioneer in accelerating annual energy production (AEP) for wind turbine stakeholders, has launched WindESCo Swarm™ - the world’s first...

Published in Easy Engineering, 11/9/23 WindESCo is a wind turbine optimization company, helping IPPs and owner/ operators increase the annual energy...